Business Expenses Deduction 2024 – It’s that time of year when most business owners are looking back on their 2023 numbers and trying to uncover expenses that could potentially lower their tax bill. Is this you? If so, let’s dive into . Taxpayers can take advantage of numerous tax deductions, also known as tax write-offs, to lower their tax bill or receive a refund from the IRS come tax season. Learn More: Trump-Era Tax .

Business Expenses Deduction 2024

Source : www.freshbooks.comSmall Business Expenses & Tax Deductions (2023) | QuickBooks

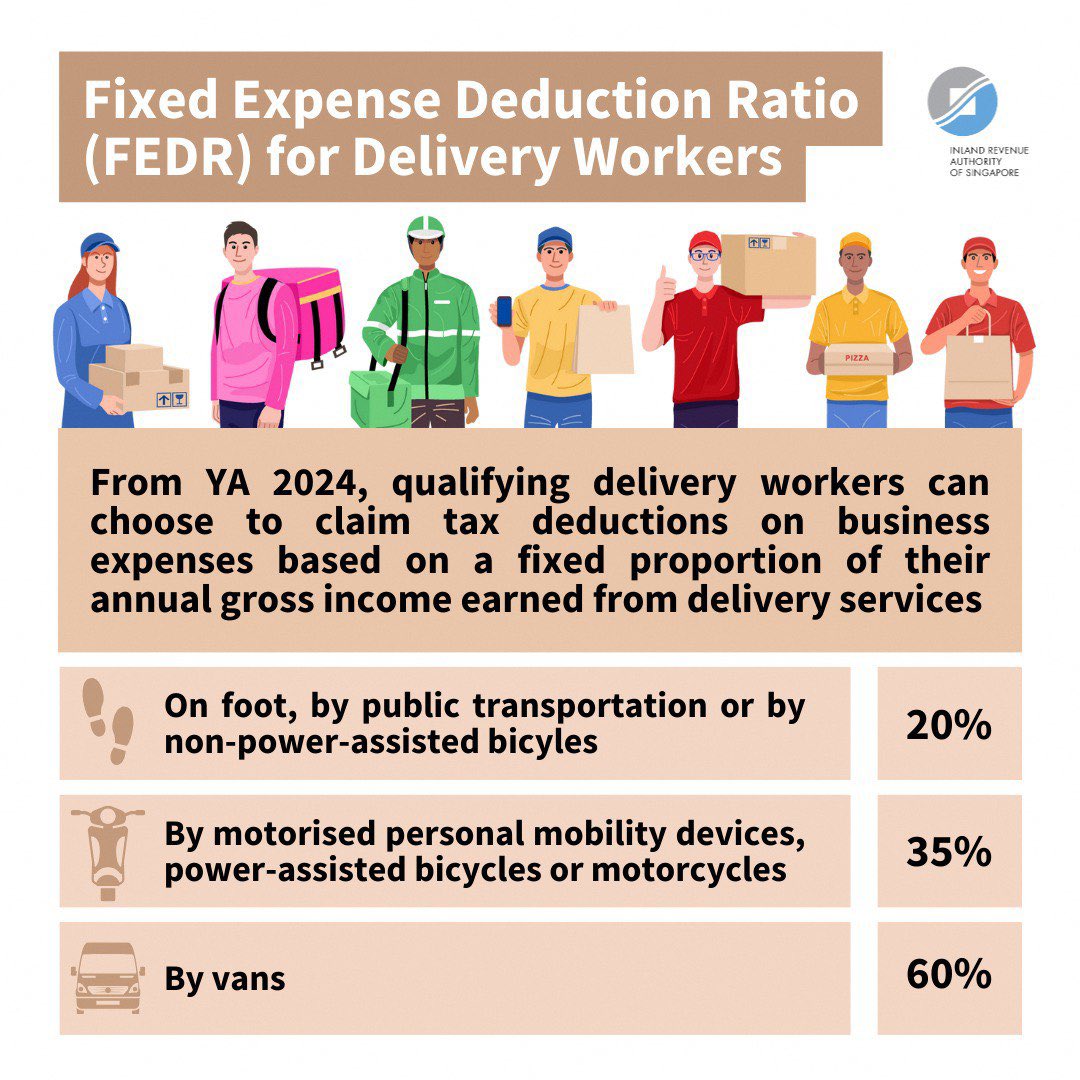

Source : quickbooks.intuit.comIRAS on X: “Good news for delivery workers! 🙌🏻 With effect from

Source : twitter.comSmall Business Expenses & Tax Deductions (2023) | QuickBooks

Source : quickbooks.intuit.comDeducting Meals as a Business Expense

Source : www.thebalancemoney.com2024 State Business Tax Climate Index | Tax Foundation

Source : taxfoundation.orgSmall Business Expenses & Tax Deductions (2023) | QuickBooks

Source : quickbooks.intuit.com22 Small Business Tax Deductions Checklist For Your Return In 2024

Source : www.insureon.comSmall Business Tax Deductions Checklist 2024 Blog Akaunting

Source : akaunting.comSection 179 Deduction – Section179.Org

Source : www.section179.orgBusiness Expenses Deduction 2024 25 Small Business Tax Deductions (2024): Key Takeaways – Can You Take the Home Office Deduction? Many people whose jobs became remote during the COVID-19 pandemic are still working from home. Some work entirely from home or on a hybrid . Over the years, the IRS has allowed some unusual tax deductions, but the circumstances were very specific. Basically, taxpayers must prove the items were necessary or a legitimate business expense. .

]]>

:max_bytes(150000):strip_icc()/deducting-business-meals-and-entertainment-expenses-398956-Final-edit-9a8310ac2d5f422c87530d3d085e45d6.jpg)